If you run your own business or work as an independent contractor, you know that handling your taxes can be stressful. You may be asking yourself: What is my tax rate? How should I calculate my taxes?

In the following article, we’ll outline all you need to know about filing self-employment taxes. We will cover how to determine if you’re self-employed (SE), how to calculate SE taxes and your next steps when it comes to small business tax preparation.

WHO IS SELF-EMPLOYED?

According to the IRS, you are considered self-employed if any of the following apply:

- You carry on a trade or business as a sole proprietor; or

- You are a member of a partnership or limited liability company that files a Form 1065, U.S. Return of Partnership, that carries on a trade or business.

Simply put, this guidance means that anyone who is in business to make money is considered to be self-employed. This can be a freelancer, consultant or small business, but not a large corporation. It is also important to note that self-employment doesn’t have to be something that is full time.

Take ride-share drivers who use W9’s for instance. According to the IRS, these individuals are self-employed even though their income is likely generated on a part-time basis. Believe it or not, driving for Uber is owning your own business because you are operating as an independent contractor.

However, there is no formal business structure required so long as business taxes are reported on a Schedule C with your personal tax return.

What does the law say?

The Federal Insurance Contribution Act (FICA) is the law that mandates a Social Security and Medicare tax on employment. These are called FICA taxes, which are withheld from an employee’s paycheck. While all net earnings are subject to Medicare tax, there is a limit for Social Security (this maximum number changes annually because of inflation).

But just because you’re self-employed doesn’t mean you’re off the hook. The Self-Employment Contribution Act (SECA) outlines Social Security and Medicare mandates that must also be established for those who are self-employed. These SE taxes are paid by all small businesses, be they sole proprietors, partnerships, LLCs or S-corporations. The tax rate will be based on the net income of the business and taxes paid to the Social Security Administration.

Self-employed individuals report earnings to Social Security when they file federal income taxes on a form Schedule SE which is required when net earnings exceed $400 each year.

What happens if you are both self-employed and an employee?

Some individuals are both employees and self-employed. For example, let’s say you run a local cake baking service while working full-time as a nurse for a hospital. You must pay taxes on income from all sources. This means you will pay SECA on your cake business and your portion of FICA (your employer pays the other half of the FICA tax due). Just like FICA taxes, there is no limit for SECA. However, remember there is a limit for Social Security.

The takeaway here is that self-employed individuals take on the full tax burden based on their business income. Changing your business structure can help you to reduce this burden.

A NOTE ON BUSINESS STRUCTURES

Establishing a business entity for your operation is one of the most important considerations as it relates to taxes. The five main types of business entities are: sole proprietors, LLCs, partnerships, corporations and S corporations.

Forming a Limited Liability Company (LLC) and electing to file as an S corp will allow the business owners to avoid double taxation and separates liability from the owner. This structure also allows you, as the business owner, to collect a salary and is especially beneficial if your business is highly profitable. For instance, if you earned $100,000 as a graphic designer in 2016 and filed as a sole proprietor, you would have paid self-employment taxes on the entire amount. However, had you created an LLC, and paid yourself a reasonable salary based on national or local benchmarks, only the salaried portion would be subject to self-employment tax.

TAX BREAKDOWN

In 2017, the total tax percentage for SECA is 15.3%:

Social Security

This portion of the tax is 12.40% with maximum taxable earnings of $127,200.

Medicare

The tax percentage is 2.90%, with no lifetime limit.

Taxes are to be paid on your net business income. This is calculated by subtracting your allowable business deductions and depreciation from gross earnings. However, it is important to know that not all income counts towards Social Security. These other income streams include:

- Any interest from loans, unless your business is lending money;

- Dividend income from shares of stock and interest on bonds, unless you receive them as a dealer in stocks and securities.

- Rentals from real estate, unless you’re a real estate dealer or regularly provide services primarily for the convenience of the occupant; or

- Income collected from a limited partnership.

HOW IS SELF-EMPLOYMENT TAX CALCULATED?

As mentioned above, employees and their employer share the employment taxes equally, while self-employed individuals are responsible for the full tax balance.

Calculating self-employment taxes can get a bit tricky if you don’t fully understand how tax accounting works. Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment. To arrive at your business net earnings, subtract your business expenses from business revenue, then multiply the difference by 0.9235.

While this may seem like odd math at first glance, there’s a good explanation for using 92.35% versus 100%. Self-employed individuals are allowed to reduce self-employment income by half of the self-employment tax before applying the tax rate (i.e. 0.5 x 15.3% = 7.65%). This 7.65% deduction takes into account the employer-portion of the FICA tax which the business would be able to deduct if you were paid as an employee.

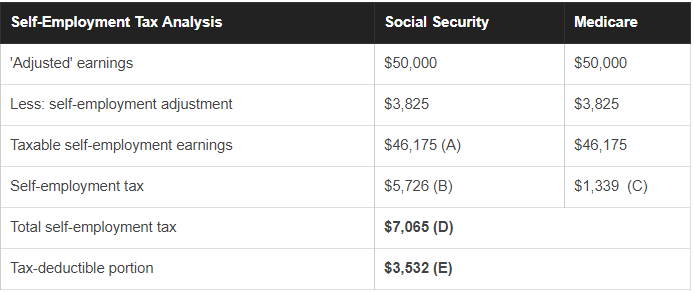

Below is a basic calculation, adapted from the Motley Fool, that will provide some understanding of how much you should expect to pay in SECA taxes based on adjusted self-employment income of $50,000, filing status and the typical self-employment deduction.

Your total self-employment tax of $7,065 is comprised of $5,726 Social Security tax and $1,339 Medicare tax.

- Taxable self-employment earnings = $50,000 x 0.9235

- Social Security self-employment tax = $46,174 x 0.124

- Medicare self-employment tax = $46,174 x 0.029

- Total self-employment tax = $5,726 + $1,339

- Tax-deductible portion = $7,065 x 0.5

Next Steps

Self-employed individuals must compute these calculations on a Schedule SE. If you find this to be an overwhelming process, be sure to contact a tax expert to help you with your small business tax preparation needs.

Your total self-employment tax amount of $7,065 should be recorded in Form 1040 in the “Other Taxes” section. The tax-deductible portion of $3,532 must also be reported on Form 1040 as an adjustment to income which reduces your Adjusted Gross Income and the amount of income tax you owe.

The IRS says that self-employed individuals are generally required to file an annual return and pay estimated tax quarterly. Use Form 1040-ES, Estimated Tax for Individuals to calculate your quarterly taxes. You can submit your quarterly payments online through the Electronic Federal Tax Payment System. Alternatively, the IRS also permits payment via vouchers that they supply. When you file your actual annual tax return in April, you are responsible for paying the remaining balance of taxes owed that were not covered by your quarterly payments.

REPORTING WITH INCOME LOSS - OPTIONAL METHOD

If your actual net earnings fall below $400, your earnings can still count toward Social Security under an optional method of reporting.

You can use this method if you have income from farming, non-farm income, or a combination of both. You can use the optional method only five times in your life when reporting non-farm income. There is no limit on using the optional method of reporting farm income. Here is how it works:

- If your gross income from farm self-employment did not exceed $7,800, or your net farm profits were less than $5,631 during the tax year, you may report the smaller two-thirds (2/3) of gross farm income (not less than 0) or $5,200; or

- If your net income from non-farm self-employment is less than $5,631, and less than 72.189% of your gross non-farm income, and you had net earnings from self-employment of at least $400 in two of the prior three years.

- You can use both the farm and non-farm methods of reporting, and can report less than your total actual net earnings from farm and non-farm self-employment, but you can’t report less than your actual net earnings from non-farm self-employment alone. If you use both methods to figure net earnings, you can’t report more than $5,200.

Farming can be a convoluted tax topic since it’s a niche area and not everyone understands tax laws designed to benefit farmers.

Even if you don’t owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax. This is true even if you already receive Social Security benefits.

SUMMARY

- Self-employment taxes exist to ensure that individuals who are self-employed pay contributions to Social Security and Medicare. Everyone is required to contribute to both government programs.

- Your tax rate is calculated as 15.3% of your business income from self-employment. In 2013, the IRS implemented an additional Medicare tax rate of 0.9 percent which applies to wages, compensation and self-employment income above a threshold amount. See the Questions and Answers for the Additional Medicare Tax page for more information.

- Business tax deductions reduce your earnings from self-employment, thereby lowering your regular income tax burden and your self-employment tax. One example includes the home office deduction. You can only take the home office deduction if your home is the principal place of your business and the space within your home is used exclusively and regularly to conduct your operations.

- Use form SE to estimate your self-employed taxes. This tax amount is then transferred to 1040 on line 58 as your self-employment tax. Any amount owed for self-employment tax is added to your personal tax liability current tax year.

- Self-employment taxes aren’t withheld from your business income (like employment tax). Self-employed individuals are generally required to file an annual return and pay estimated tax quarterly.

TALK TO A PROFESSIONAL THIS TAX SEASON

Tax laws seem to change every year making it difficult to keep up if you’re not a trained accountant. Filing self-employed tax is no different.

Unfortunately, doing your own small business tax preparation comes with financial risk. If you calculate this amount incorrectly, have an inability to pay or under pay the IRS, you could be charged a large tax penalty. However, by getting professional help, you can avoid costly mistakes.

Here at Ignite Spot we can help with calculating your taxes so you can focus on your business. We work with self-employed individuals from retail, government contractors, business consultants to freelancers. Let us help you get on track by establishing an estimate for quarterly tax payments to prevent potential shortfalls when tax season rolls around.

Contact us to make an appointment for any of your small business tax preparation or accounting needs. By letting us handle your small business tax preparation needs, you can focus on what it is that you do best. In other words, taking good care of your customers, growing your business and gaining a competitive advantage in your industry.