There's a right way and wrong way to do everything in life. If you decide to outsource bookkeeping services for your company, you'll want to read the guide below to make sure you get started on the right foot.

There's a right way and wrong way to do everything in life. If you decide to outsource bookkeeping services for your company, you'll want to read the guide below to make sure you get started on the right foot.

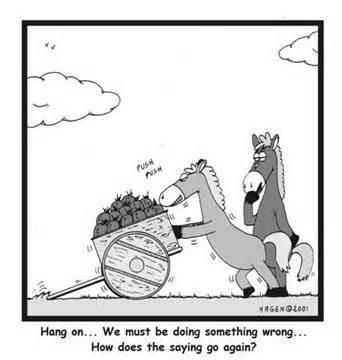

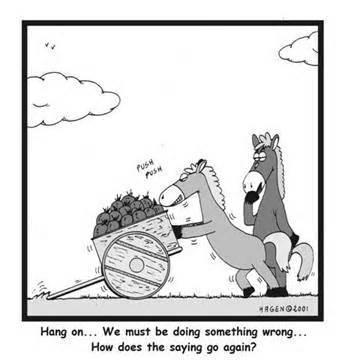

First, The Wrong Way To Do It.

Most people outsource bookkeeping services because the accounting work takes too much of their time. When they finally give it away, there's an extreme feeling of relief knowing that someone else is doing the work. Unfortunately they give the bookkeeping team access to the QuickBooks file and then walk away hoping that everything will work out. You would never do that, right?

Many assume that because they 've hired a professional to take over, the bookkeeping will work out perfectly without their initial input. Obviously this is not the case. You know your business better than anyone, and your input in the beginning of your bookkeeping relationship will determine the effectiveness of your new accounting team in the future.

In short, don't hire a firm and then expect them to sort everything out. You still have some work ahead of you, but if you put in the time, you'll soon have an automated accounting system that needs very little from you.

The right way to outsource bookkeeping services

If I were a business owner getting ready to pass my accounting work on to a firm like Ignite Spot, here's how I would do it:

Tip #1 - Identify 3 to 5 Priorities

I would write out my top 3-5 priorities that I would need to see from my accounting team. For example, maybe I want to see cash balances daily, I need a specific report each week, and I expect all invoices to be sent out by 5 p.m. every Thursday. You get the idea.

Be very specific and keep the list under control. Start with the most important needs. You can always add later, but if you give your accounting team 74 things that need to happen immediately, chances are that you'll be disappointed. They have a learning curve and will need time to master your top priorities first.

Tip #2 - Have an Effective Training Day

I would make sure that everyone in my company who will be working with the accounting firm will be present during the first day of training. I would want to make sure that everyone knows each other, their functions, and how they will work together.

Tip #3 - Central Data Storage

Ensure central data storage. It can become a nightmare if some of the accounting data is stored on Fred's computer, some of it is lost in Emily's email, and the rest is bouncing around with your accountants.

At Ignite Spot, we use www.podio.com as our central communication, data, and workflow structure. Everything related to your accounting resides there so that the entire team can work effectively and quickly with each other.

Tip #4 - Meeting Rhythms

Create a reporting and meeting rhythm. I would meet with my accountant and choose a revolving meeting once a week where we could get together for 1 hour to discuss accounting needs, cash positions, and strategy. I would then block that time out in my calendar and make sure that I made it to every one of them.

Tip #5 - Be Prepared to Answer Questions

Be prepared for 30 to 90 days of training. Regardless of how good your online bookkeeper is, he or she will have questions. Most of those will come during the first 30 to 90 days of work. Be ready for that and be excited for the ability to discuss those questions. A bookkeeper who doesn't ask questions and simply books things as they see fit is a disaster. You want someone on your team who cares about your financial reports enough to get them right.

Tip #6 - Connect Your CPA

Notify your CPA that you now outsource bookkeeping services and that you want to make an introduction. Your online bookkeeper needs to know your CPA and be comfortable enough to call him or her as needed. If your accounting team has an in-house CPA division like Ignite Spot does, consider having the firm do all of your bookkeeping and tax work so that everything is done under the same room to simplify communications.

I hope this list helps you get the most out of your new relationship. So many business owners outsource bookkeeping services today and it makes sense to have a plan before you do it.

Further Reading

16 Reasons to Use Bookkeeping Services

Accounting Services vs. Bookkeeping Services