#1 - Time Is Totally Money...And Time

You know it. I know it. So why do you waste your time doing something you're not good at? You're good at doing what you're passionate about. And we know you're not passionate about QuickBooks or bank reconciliations. But accountants are passionate about it. This is one of the first things you should delegate ASAP.

Finance & Accounting was one of the first things businesses began to outsource, which means that it has become a competitive and efficient way to take care of the nitty-gritty numbers that keep you awake at night.

By outsourcing your accounting operations, you free up valuable time that can be better spent elsewhere. - Business2Community

#2 - What Will It Cost Ya?

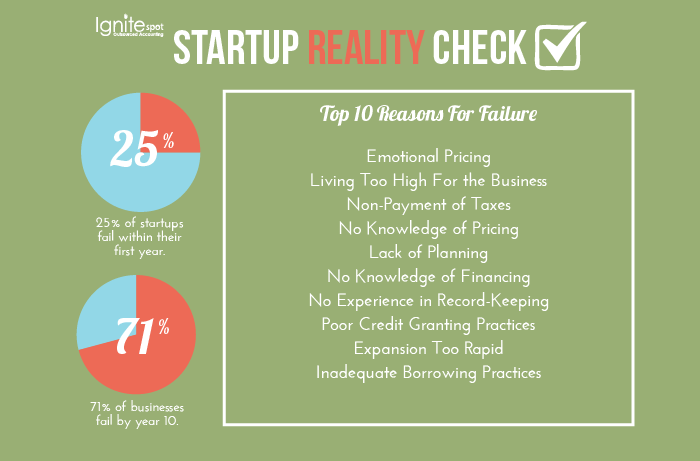

Money is thin, right? Well, nothing personal, but maybe you might have more of it if you invested in someone to keep you informed and smart. Do you really need that fancy company car or 5-star hotels? Why not put that extra cash towards getting some help to become profitable rather than just another statistic.

#3 - Accountants Are Awesome at Accounting

By outsourcing your accounting operations to a professional accounting firm, you’re effectively hiring a team of experts. Professional accountants know the tax codes and laws backwards and forwards—it’s their job. They work around the clock for your business by keeping up with the latest tax information, affording you full-time coverage for only part-time pay. Staffing options are considered and executed per task, so you’ll only have the most experienced and qualified individuals on your side, right where you need them.

-Business2Community

Your job is not accounting. If you hire a professional or a group of professionals they should keep you informed with easy-to-read reports, and give you regular updates. You're not an accountant, but you should trust that your bookkeepers, in-house or outsourced, will explain the status of your accounts plainly and clearly. If you're lucky, your accountant(s) can offer profit coaching as well.

#4 - It's Not Your Fault

If you're doing the books yourself, you've probably made quite a few mistakes by now. Those mistakes might not just cost you money and time, but they may end up on your record or get you into some serious trouble. Hiring an outsourced service will give you a better chance at steering clear from any shady business. Let's keep it clean, people.

No one wants the worst to happen...but if it does, you can point your finger at someone else, and you'reOutsourcing reduces business liability in two ways. First, by letting a third party handle the books, any errors do not result in criminal prosecution as the business can easily point their fingers at the virtual bookkeeper. Second, having a specialist handle the bookkeeping drastically reduces the number of errors and associated liabilities.

off the hook. Your outsourced accountant should keep you safe and legal.

#5 - Control

Of course, nothing beats having a CFO in-house where you can walk down the hall at any moment to ask a question and get an immediate answer, or suggest changes to implemented now. However,

Many companies don’t realize going in that they manage an outsourced provider more stringently than their in-house resources were managed.

-Jag Dalal

Yes, you are still the CEO, and you are ultimately responsible for what everyone is doing. It's tough to find a balance between managing and delegating. This one is in your court--find people you can trust, and get rid of bad hires ASAP. Who is on your team is always in your control.

You've got this. Get your F&A under control, and find an expert. Be the boss.

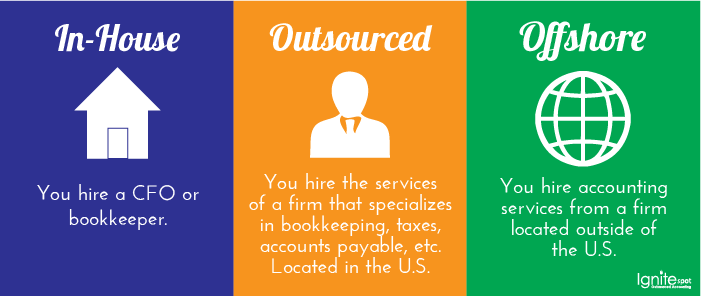

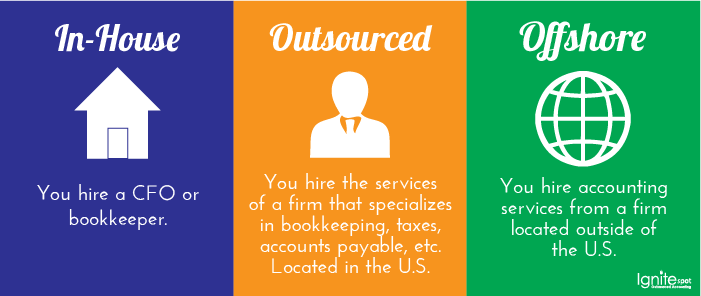

Get a good idea of what outsourcing your accounting services might look like:

References:

(2013, July 12) Mullich, Joe. The Benefits of Outsourcing Finance and Accounting. Forbes. Retrieved on August 12, 2014 from http://www.forbes.com/sites/xerox/2013/07/12/the-benefits-of-outsourcing-finance-and-accounting/

(2014) Bryant, Jacqueline. Outsourced Accounting Services. Nonprofit Accounting Basics. Retrieved on August 12, 2014 from http://www.nonprofitaccountingbasics.org/reporting-operations/outsourced-accounting-services

(2013, May 29) Sultan, Hussain. 6 Reasons to Outsource Your Accounting Operations. Business2Community. Retrieved on August 12, 2014 from http://www.business2community.com/finance/6-reasons-to-outsource-your-accounting-operations-0508244#!bCdeOH

(2012, August 20) Prabhakar, Deepaman. What You Need To Look For If You're Outsourcing Your Accounts. The Guardian. Retrieved August 12, 2014 from http://www.theguardian.com/small-business-network/2012/aug/20/outsourcing-accounts-small-business

(2014, January 1) Startup Business Failure Rate by Industry. Statistic Brain. Retrieved August 12, 2014 from http://www.statisticbrain.com/startup-failure-by-industry/

What To Read Next:

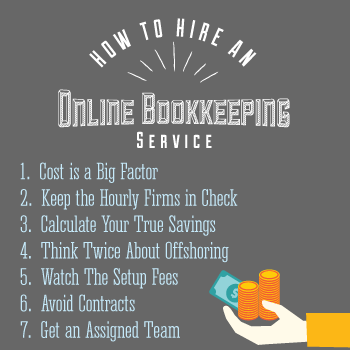

Bookkeeping Services: A Crash Course

How Small Business Bookkeeping Service Helps You Turn a Greater Profit

Hiring Bookkeeping Services for Small Businesses