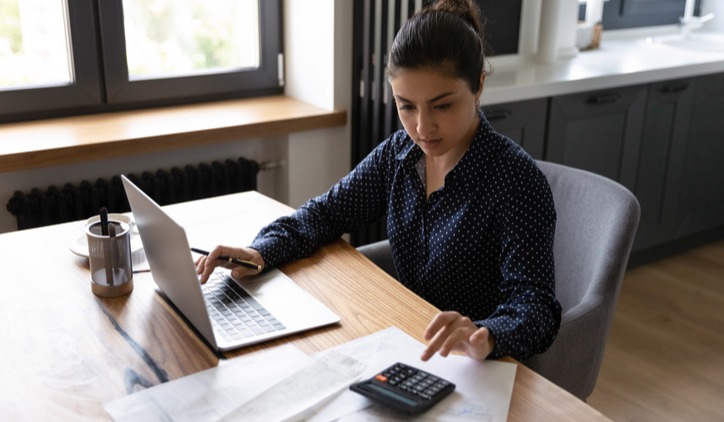

Monthly Bookkeeping Services Tasks

Just like owning your home and staying on top of bills to keep the lights on, your business has several monthly bookkeeping services obligations that can be outsourced. From getting paid to making your own payments, be sure to check off all the boxes, so you can keep planning toward a successful future.

✅ Prepare and send invoices.

Stay on top of sending invoices—it’s helpful for customers and your team. Send them out while your services are still fresh in customers' minds. The sooner you do it, the sooner you'll get paid.

✅ Record customer billings.

Keep your accounting software up to date. That means that as soon as you send billing statements and invoices, record them in a place that will allow you to easily assess customer payment histories. Don’t get distracted by the day-to-day tasks of running your company and forget where you left off with invoicing!

✅ Record customer payments.

Just got paid, Friday night. (Excuse our ‘90s vibes.) Getting paid is sweet, so make a note of it. Suddenly, your accounting software is one of your favorite things.

✅ File vendor bills and payment records.

We may be a little old school, but we like physical paper copies of all bills. Anyone else? File your documents in a readily accessible way—and alphabetically. Have e-bills? Print those out too, so everything’s in one place.

✅ Make vendor payments.

If you record incoming payments, you should also record outgoing payments. Writing checks is hard to do—goodbye, hard-earned money—but you've got to do it and stay on top of vendor payments.

✅ Update payroll files.

If you have employees to pay, at least you’re not going it alone. Your employees help you run your business, so return the favor by staying on top of payroll. Show up for them in this way, and they'll continue to grow your business.

✅ Review the cash flow forecast.

Always keep your cash flow goals in mind. Reassess weekly, and make adjustments as necessary. Even better? Get on a schedule with weekly, monthly, and annual cash flow projections to take stock of both your immediate and holistic cash flow goals.

Quarterly Bookkeeping Services Tasks

There comes a time when you have to pay the piper. Your quarterly bookkeeping services center around taking stock of how your business is doing at key checkpoints and probably your least favorite thing: doling out payments. From payroll to taxes, start shaking up the money jar to ensure your business is sharing its dollars appropriately.

✅ Evaluate annual profit and loss estimates.

How's everything looking so far this year? Take a look at your revenue, cost of sales, gross profit, and expenses. How do these actual amounts stand up to your projections? What are your top priorities for the quarter to hit your goals? Take the time to strategize and get back on course if you've strayed.

✅ Make quarterly payroll payments.

You need to make quarterly payments on payroll. These payroll filings and payments are due on the last day of the month after the quarter ends. To do this, use Form 941 and any state-specific filings. To stay on track, schedule a day or two at the end of each quarter to complete all your filings.

✅ Make quarterly sales tax payments.

Quarterly sales tax payments are required too. Taxes aren't just a yearly thing when you run a small business, so stay up to date and informed.

✅ Make quarterly income tax payments.

Just like sales tax, you also need to pay income tax every quarter. Make sure you're accounting for these taxes along the way; they're killer if you put them off.

Yearly Bookkeeping Services Tasks

Ah, the finish line. By the end of the year, you should have a pretty good idea of how your business performed and its financial position. From here on out, it’s tax time. Dun, dun, dun. Don’t sweat it. By keeping up with a few bookkeeping services tasks, you’ll be prepared to file your business taxes.

✅ Analyze year-end inventory.

The end of the year is a season of reflection. Ask yourself key questions to analyze a year’s worth of performance. How did the year go? What's leftover? What services or products did better or worse than you thought? What do you need to order for next year?

✅ Fill out IRS forms.

IRS or IR-annoyed? You need to complete annual forms. Get it out of the way early and return to your regularly scheduled programming. Think of it like putting off the laundry until you have nothing to wear. Stay on top of your tax filings, so they don't pile up and overwhelm you when deadlines approach.

✅ Review full-year financial reports.

Reviewing your financials is kind of like high school midterms—even if you didn't do as well as you projected, it's an opportunity to improve and make goals. What did this year teach you? How can you apply it and change things for the better?

✅ Review tax returns before giving them to your accountant.

You want to know the fiscal health and standing of your small business. Of course, your accountant will ensure that your return is error-free, but you should review it, so you know your business position and where you’re going.

Discover the Benefits of Professional Outsourced Bookkeeping Services

It may seem daunting to keep up with so many of your business’s financial activities throughout the year. Paying bills? Managing taxes? Completing year-end filings? It can be a lot to handle, but you can make it easier on yourself. Join forces with a professional outsourced accounting team to manage your bookkeeping services and keep your day-to-day accounting tasks on track. Not sure if it’s the right move for you? Download our e-book to learn if outsourced accounting is the right fit, and get in touch to discuss your needs.