![]()

Can you strike the profitable pose? We invented it here at Ignite Spot. Kinda of awesome, don't you think? By the end of this article, you may find yourself rocking the same pose.

Who doesn't love a good hack? I know that I sure do.

We're all looking for that efficiency or lifestyle hack that makes everything work. I may not be an expert in those fields, but I am the guy for profit building hacks. As a business owner, you're always on the lookout for ways to make your company cleaner, faster and more affordable. Today's profit hack will make a huge difference in your company.

Here's my promise to you in this article:

- I'll give you a simple 7-step plan that you can follow

- Your company will track revenue like the big boys

- You'll instantly get more clarity into your company's finances

Anyone can do this. You don't have to have a degree in accounting. You can even hate numbers and you'll still be great at this. I've taught this system to construction workers, marketing mavens, and multi-million dollar enterprises.

Now it's your turn.

Step 1: Getting Started

I want you to be able to see how much you're billing by revenue channel and also by location. This can get a little confusing, so to get started, let me define each term:

- Revenue Channel: Most companies have more than one revenue channel. A channel represents a group of similar products or services that you sell. For example, if you own a retail store that sells baby supplies, your revenue channels may be clothing, furniture, toys and strollers.

- Location: Some businesses have more than one location. For example, you may have a retail location in Chicago and one in Salt Lake City.

As a business owner, you need a report that shows you how much you're selling by revenue channel within each location. Furthermore, you need all of that information on a single page.

The goal is to begin tracking your revenue accurately. I want you to see what the end result is going to be before we dive in.

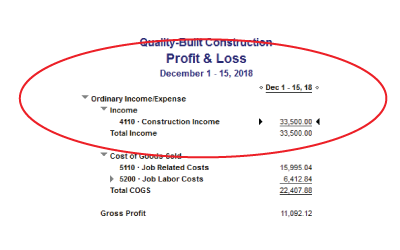

Before Applying Our System

In the example below, we're looking at a profit and loss statement for a fake construction company. Notice how the report displays their income. It all falls under one line titled "Construction Income". Boo! How is management supposed to know which divisions of their company are performing well?

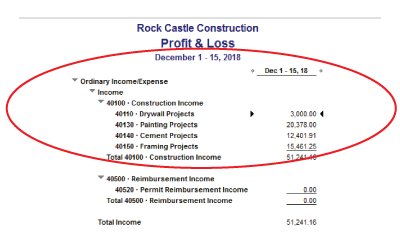

After Applying Our System

The example below does a better job of showing where we're headed. The construction company has broken up their revenue into 4 revenue channels. This way, the management team can analyze how their painting services compare to their other services as an example.

To get started, here's what we're going to need:

- A list of all of your locations. Most companies only have one location.

- A list of all of your revenue channels.

- Access to your accounting software. I'm going to be demonstrating this on QuickBooks today. If you use a different software, you'll still be able to get a lot out of the exercises below.

Step 2: Too Much Data is a Bad Thing

I need to warn you about a major problem. When I dig into this with people, there's a tendency to over-complicate it. How? By creating a million revenue channels. In my example of the baby store above, we came up with four revenue channels. It would be possible to turn those four channels into 40 if you wanted to.

I need to warn you about a major problem. When I dig into this with people, there's a tendency to over-complicate it. How? By creating a million revenue channels. In my example of the baby store above, we came up with four revenue channels. It would be possible to turn those four channels into 40 if you wanted to.

The data geeks of the world, and yes I am one of them, love breaking data down and analyzing it. So why not get more granular with more revenue channels? For example, instead of having a revenue channel called "Strollers" we could have one for each kind of stroller. We could have jogging strollers, double strollers, umbrella strollers, etc. Heck, once we get down to that granular of a level, we could go further and have a revenue channel for each brand name so that we can see how much revenue we are generating by brand. Right?

Wrong.

The point of today's exercise is not to over-complicate your accounting system. It's to give you clear and concise data that is actually useful. When you create a million revenue channels, several things happen.

- Your bookkeeper will struggle to remember which transaction goes into which revenue channel.

- There are going to be many more mistakes.

- Your reports are going to take longer to create and therefore be late. You need to get data as quickly as possible, and if your bookkeeper is having to research every transaction to get it in the right bucket, you'll get your data long after decisions need to be made.

The adage of keep-it-simple-stupid isn't accurate. We do want to add a bit of complexity by creating your 3 to 5 revenue channels, but we don't want to flood the boat by creating 100 of them.

Resist the urge and you'll be more profitable. Trust me. I've seen too many businesses sink because of this.

The 2010 International Workplace Productivity Survey asked 1,700 white collar workers how they felt about the amount of information they received. 52% of those professionals stated that there was so much data coming at them that they felt demoralized. I promise you now that if you create too many revenue channels, your staff will struggle with it and you're reports will suffer for it.

Step 3: Revamp the Chart of Accounts to Track Revenue

Have you built your list of locations and revenue channels? If so, let's get to work. I'm going to walk you through how to adjust your chart of accounts which is the first major step. Once completed, you'll have the framework for accurate reports! Click the play button and follow along.

Step 4: Adjust Your Default Posting Accounts

The next step is to adjust each one of your products or services in your accounting software so that they automatically post to the correct accounts when you sell something. In the video below, I walk you through how to do this.

Step 5: Setup Classes for Locations

If you're using QuickBooks, you have the option to use the class tracking feature. If you're in a different software, there will likely be a feature that allows you to track your sales by location. Watch the next clip to learn how to manage your classes correctly.

Step 6: Train Your Bookkeeper

Now that you have everything set up to track revenue correctly, you'll need to take some time with your bookkeeper to explain to them what your goals are. Here are the things that you should train on:

- Review your new chart of accounts and explain each of your revenue channels

- Make sure they set up any new products or services under a revenue channel

- If you have more than one location, explain that each transaction must use a class

Step 7: Analyze & Make Better Decisions

Once you get your system set up, you job is to maintain it. At the end of each month, have your accounting team print off a copy of your profit and loss statement. Review it with your accounting team and have an in-depth discussion about each one of your revenue channels. Which ones are performing really well? Which ones are pulling your company down? Also, don't forget to compare locations if you have more than one!

Once you get your system set up, you job is to maintain it. At the end of each month, have your accounting team print off a copy of your profit and loss statement. Review it with your accounting team and have an in-depth discussion about each one of your revenue channels. Which ones are performing really well? Which ones are pulling your company down? Also, don't forget to compare locations if you have more than one!

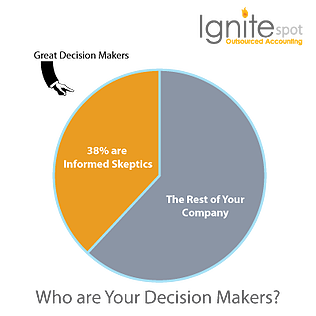

It's important to understand that the movement towards better data alone won't make you more profitable. Getting information is only useful if you know what to do with it. Authors Shvetank Shah, Andrew Horne, and Jaime Capella describe how good data won't guarantee good decisions in their Harvard Business Review article published in April of 2012. They reviewed 5,000 employees at 22 different global companies and sorted them into 3 different classes.

Unquestioning Empiricists: These people trust analysis over judgment. In other words, they follow the numbers regardless of what their gut tells them.

Visceral Decision Makers: These people go with their gut feeling every time regardless of what the numbers say.

Informed Skeptics: According to the study, this was the best kind of decision maker. This person considers the numbers as well as the situation.

The study showed that only 38% of people were Informed Skeptics. That means that, on average, 62% of the people in your organization are going to make decisions based completely on their gut or on the numbers.

Your job as the business owner is to find and empower the 38% that are Informed Skeptics and put them in the driver's seat.

To bring this full circle, you've gone through steps today to improve how you track revenue on a profit and loss statement. In the hands of the Informed Skeptic, your business will have a greater chance of improving profits.

So, are you ready to rock the profitable pose? Go on. You can do it. I'm so excited for you and your business. Keep up the good work and remember that getting profitable is all about giving you the opportunities to change the world for the better!

References:

(2010, October 20) LexisNexis . New Survey Reveals Extent, Impact of Information Overload on Workers; From Boston to Beijing, Professionals Feel Overwhelmed, Demoralized. http://www.lexisnexis.com/en-us/about-us/media/press-release.page?id=128751276114739

(April 2012) Capella, Jamie, Home, Andrew, and Shvetank, Shah. Good Data Won't Guarantee Good Decisions. Harvard Business Review. Retrieved July 2, 2014 from http://hbr.org/2012/04/good-data-wont-guarantee-good-decisions/ar/1

What to Read Next:

Grew from $0 to $80 Million in Revenues