You probably already have a bookkeeper. But your bookkeeping and accounting teams are probably too swamped to notice when your cost per unit increases. Suddenly, you’ve run out of cash. What now?

There has to be a better way ... right? We’ll do better and give you seven. Read on to learn our top seven strategies for more effective cost management.

Why is it important to manage costs?

Cost creep—or price creep—occurs when prices of assets slowly and steadily rise as people become used to and willing to pay the incrementally higher prices. If you don’t have someone dedicated to monitoring both fixed and variable expenses, cost creep can occur.

Manage your company’s expenses with several verified strategies.

1. Define your fixed and variable expenses.

Before you get started, have your accounting services firm print all the transactions for the prior month and group them by vendor. Organize them all by writing "fixed" or "variable" next to each vendor.

As a refresher, a variable cost is one that is directly tied to revenue—whether that’s raw materials, direct labor, or similar. On the other hand, fixed expenses include any costs not related to selling your products or services—from rent or insurance to administrative payroll.

Note: Some companies also record semi-variable costs, a combination of fixed and variable expenses. For example, an electric bill could be broken down into a fixed versus variable expense if more energy is used when production volume increases.

Understanding your cost structure and the distinction between fixed and variable expenses is critical because it helps to streamline planning, negotiating, and forecasting.

2. Enter your budget into accounting software.

Many entrepreneurs already have a business budget but haven’t put it into their accounting software. However, when you take the additional step of setting up the software, it will grab your current costs and compare them to your budget in a budget-to-actual report throughout the month. Budget-to-actual reporting drives variance analysis, which in turn drives your expense management strategy.

3. Create a cost management strategy.

With the results of your budget-to-actual report in hand, you can assess which line items will bring your costs down. Some businesses prefer to prioritize the largest dollar amount variances because they have the biggest impact on performance. Others prefer to address the actual costs with the biggest variance from budgeted costs.

Regardless of which option you choose, there are steps you can take to reduce your variable and fixed expenses.

4. Reduce variable costs.

Variable costs are tied to changes in output, but that doesn’t mean they increase as your business grows.

Example: If you increase production by 10 percent, your variable costs might not increase the same amount.

There are many ways to grow your margin without sacrificing quality:

- Look for volume discounts. If your cash flow can handle it, take advantage of when vendors allow you to purchase larger quantities of goods at a discounted rate. If your supplier doesn’t explicitly offer this as an option and you’ve maintained a good relationship with them, it can’t hurt to ask.

- Review vendor contracts regularly. Review your vendor contracts annually or biannually, and set reminders for expiring ones. You need enough time to shop around for other suppliers with favorable terms before renewing any vendor contracts.

- Centralize purchasing: If possible, appoint one person in your company to oversee purchasing as well as contract negotiation for everything from internet services to ordering office supplies. By centralizing this function, this person becomes specialized in making fiscally responsible decisions.

Bonus! Watch our “Improve Your Cash Flow Through Better Expense Management” webinar for more insights.

5. Reduce fixed expenses.

It’s easy to become complacent about your fixed costs because they’re usually static. But there are always opportunities to keep a closer eye on these costs:

Downsize where possible. Simplify and consolidate your operations—whether that means subleasing unused space, renegotiating the terms of your lease, or finding a more affordable location.

Outsource where possible. Salaries are only part of the equation when you hire employees. You also have to consider benefits and employment taxes. Save on overhead by outsourcing expert services instead of hiring an in-house employee.

Shop for new vendors. Regularly review all contracts associated with fixed expenses. Avoid signing contracts that auto-renew, and if you do, set reminders close to their expiration date(s).

Change your compensation structure. Instead of laying off employees to save money, consider converting their pay structure to one that has a variable component—usually tied to revenue. For example, your best salespeople may accept a lower base salary if you provide a higher commission rate.

Up your energy efficiency. Small efforts help you become more energy efficient and save money each month. Turn off lights and equipment when they aren’t in use, replace existing light bulbs with LED bulbs, or install a programmable thermostat to better regulate temperatures in the office.

Your business is always going to incur some fixed costs. However, when you take advantage of opportunities to convert fixed costs into variable ones, your business will be better equipped to ride out slow sales periods.

6. Reduce your break-even point and become profitable sooner.

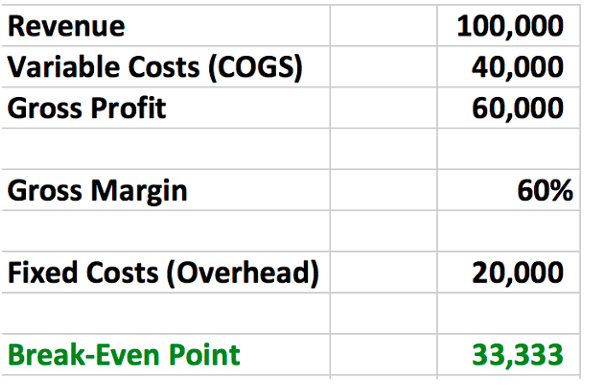

The break-even point is the amount of sales you need to generate just to produce a profit of zero. It’s the amount you need to earn in order to stay in business. Here is the formula:

Break-even Point = (Overhead Expenses + Balance Sheet Payments) / Gross Margin

Your break-even point is the amount of sales you need to generate to begin to produce a profit. It’s your yardstick in evaluating business performance—the bare minimum you need to achieve to keep the doors open.

Break-Even Point = (Overhead Expenses + Balance Sheet Payments) / Gross Margin

Example: Fictional Company A starts off with a product that costs them $5 to make. With $50,000 in variable costs, that means they sold 10,000 units.

The company wants to improve cost per unit from $5 to $4 and lower fixed costs from $25,000 to $20,000. If the company still continued to sell 10,000 units of their product, their month would now look like this:

By saving $1 on their cost per unit ($1 x 10,000 units reduces variable costs from $50,000 to $40,000) and by cutting $5,000 out of their fixed costs, their break-even point falls nearly $17,000 a month!

7. Invest in expense tracking software.

One reason cost creep occurs is poor record keeping. But there are so many software options to automate these processes to give you a better handle on your business expenses. Options such as Expensify and Divvy enable you to monitor the expenses your employees are incurring in real time, approve them automatically, and set predetermined maximums. Plus your books are easy to keep up with when the software records everything.

Run your transaction report every week.

Make cost management a consistent practice. Designate a particular day to review your transaction report each week. As the business owner, you should be able to identify any discrepancies and ensure you’re only paying for services you need.

Your goal should be to cultivate a culture of fiscal responsibility at every level of your company—moving from reactive decision-making to proactive strategy. As a result, you’ll harness better control over your business and develop a growth mindset.

Streamline cost management with expert bookkeeping and accounting services.

When it comes to your company’s financial future, you want to get it right the first time. And it’s okay to get outside help to create a strategy that will not only improve your expense management but also monitor cash flow, manage labor costs, and reduce debt. Partnering with experts for CFO services or small-business accounting services is one way to position your business for market success.

Accounting services allow you to leverage the professional expertise at a fraction of the cost of hiring an in-house executive. Plus you only pay for the help you need, exactly when you need it.

Save time and reduce risk.

Your business benefits by trusting flexible CFO and accounting services. Spend less time putting together a financial plan that works for your business and more time executing it. Plus, get a layer of protection between the CEO and the rest of the executive management to reduce risk.

Are accounting services ideal for you?

Ignite Spot has worked with hundreds of clients to improve their cost management strategies, from better defining expenses to improving expense tracking processes. But don’t just take our word for it. See what our customers have to say.

“Our Ignite Spot accountant was able to position that in a manner that made staff feel secure and also as a partner in the process.” —Dr. Dana Lambert, GlobalEd

“Right away, the books were more organized.” —Dwight and Robyn McLeod, Capstone Strategy Group

Download our e-book, Should I Outsource My Accounting Services [With Checklist], to find out if accounting services are right for you, and get in touch to see the difference for yourself. We’ll work with you to make your business profitable sooner.