One of our 500+ customers here at Ignite Spot is a really great company that matches lenders with small businesses looking for financing: Lendio.

CNBC reported that "what used to take months is now being accomplished in weeks" when small businesses partner with Lendio to find outside financing. They help over 100,000 businesses each year get funding, and they're growing rapidly.

We sat down with Lendio's Founder & CEO, Brock Blake, to find out exactly how and why Lendio works so well for small businesses and to talk about their new entrepreneurial project, Faces of Main Street. Watch the video interview below:

Working With Lendio:

- All your small business loan options are in one place. It's a marketplace to help business owners get the financing they need.

- It takes days/weeks to get a loan, rather than months.

- They'll win your trust, and you won't be able to stop talking about them.

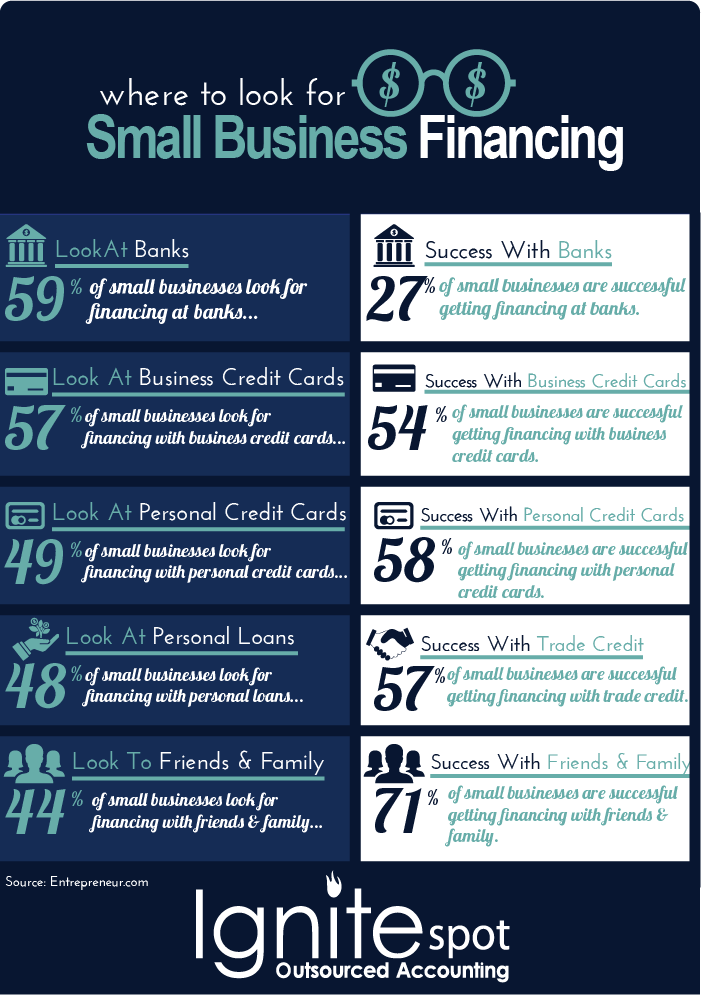

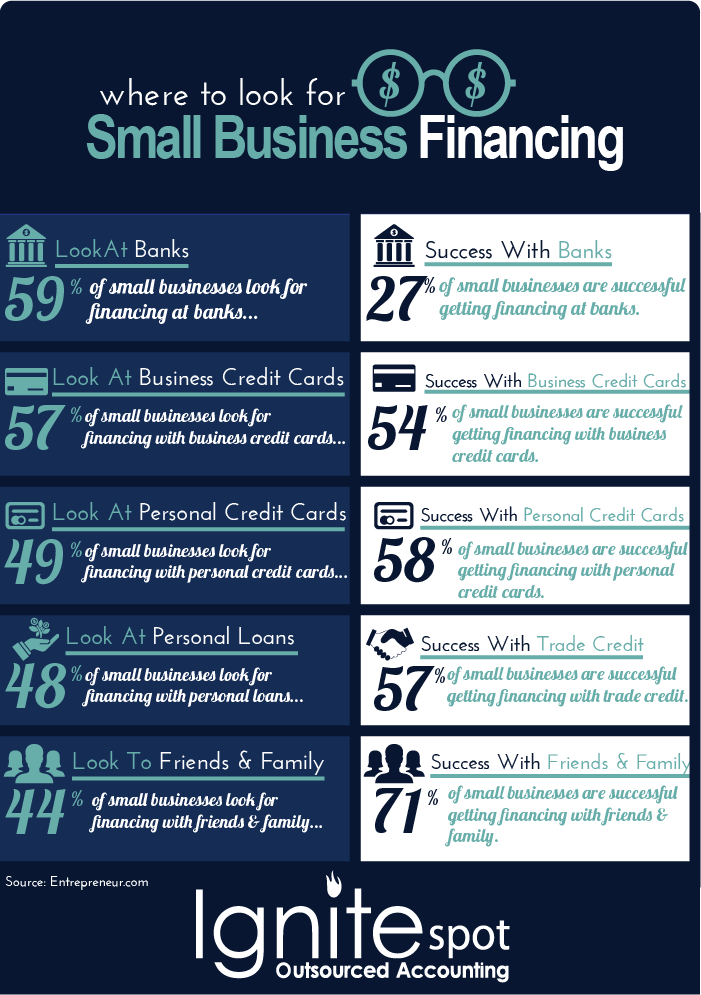

Do Businesses Actually Find Financing at Banks?

Have you been to a bank lately to apply for a business loan? What was your experience like? Were you successful? Turns out that in 2013 only 27% of businesses who went to a bank to apply for a loan were successful. Only 27%. If only 27% of businesses are successful in securing financing from a bank, where do all the other businesses find success?

71% find financing through family and friends. But we all know what that looks like at family reunions. That's where companies like Lendio can save your business and your relationships. Christmas is saved!

Want to receive updates about more interviews and articles like this?

More Video Interviews:

Neil Patel: Content Extravaganzas

Video Transcript:

Eddy: My name’s Eddy Hood.

Ann: And I’m Ann Whittaker

Eddy: We’re here with Ignite Spot, and today we are interviewing Brock Blake. He’s the CEO of Lendio. We have clients all over the country that turn to us for accounting and finance help, and they’re always asking us about ways to get lending for their businesses or more financing, and Brock’s kind of one of the gurus in this space. I know Brock personally, and he’s been gracious enough to spend some time with us. So thanks for hangin’ out, Brock.

Brock Blake: Ya, my pleasure. Thanks for having me today.

Eddy: Very good. So if you guys don’t know what Lendio is, I’m going to have Brock give you the speal, but it’s a really impressive company. I followed it since its inception and absolutely love what these guys are doing. Uh, but, Brock, if it’s alright, we haven’t gone any over of these questions, we’re just going to put him right on the spot here. These are real honest, real good questions.

I really wanted to ask, why don’t you give us the quick speal on what Lendio is and what it does.

Brock: Ya, so first of all, you know, Lendio is a marketplace to help business owners get the financing they need. And, so, to think about this, you’re a restaurant owner, a landscaper, dry cleaner--whatever it is the type of business you have, and you’re looking for finance to grow your business. And you think, “I’m going to go to my local bank, and I’m going to apply for a loan. Unfortunately, 95% of the time they do that they get declined.

It’s a painful experience, you’ve filled out all these long-format applications, you got your credit pulled and all that kind of stuff.

So, what we do, what we’ve gone out and attracted hundreds of lenders across the country that offer every type of business loan product you can think of from merchant cash advance to SBA to equipment and business credit cards, term loans, all kinds of credit, factoring--all those different loan products brought them in one spot, and it’s simple for that business owner to get the loan that they need. And, actually, we talk about it three ways:

First is options. So all the options are in one place. Second is speed. Instead of taking months to get the loans, it’s days. So speed, and, finally, it’s trust. You can get a white-glove experience that you’re going to tell your friends about.

And it’s free! We make money from the lender.

Eddy: So they don’t pay you!

Brock: Well, the business owner doesn’t pay us.

Eddy: Somebody’s gotta pay you!

So, I’m a business owner and let’s say I decided to use Lendio, what do I need to bring to the Lendio relationship to make me successful versus going to my banker ‘cause I know from my banker they’re going to want to see my tax returns and some financial statements, and they’re going to want to see a picture of me in a zebra outfit, and my social security number, and all that stuff, right? What do I gotta do to work with Lendio?

Brock: Well, ya. That’s a great question. You know, a lot of times, in addition to the things you talked about, at a bank they’re going to want to see a financial forecast, a business plan, you know, and all that kind of stuff. And, Lendio, for us to be able to get you a full offer, usually we’re going to need to see your bank statements; we want to see the inflows and outflows of what’s happening with your bank account, cash flow. Usually that’s easy online. You can go in and download your bank statements, email them to us or other things like that. In some loan products they might want to see your credit card transactions, you know. So if you’re a gas station, I want to see the transactions that are coming through credit cards. And then some loan products will want to see a tax return.

So most of them aren’t going to look at financials or business plans or things like that. They’re going to look at data that is verifiable through a third-party source. That’s why I’m saying credit card transactions, bank statements, and tax returns. You can’t doctor those in any way. You can find out if you’re going to qualify for those three pieces of data, but if you really want an offer, um, that’s what we try and do. We try to get you multiple offers from a few different lenders.

Eddy: So you get to pick.

Brock: Yes, yes. You can choose. If you want a real offer then you’re going to have to have, you know, usually those types of data. And other loan products might want other things, but we simplify that and just say here’s what you need.

Eddy: So, how many years do you need to be in business to really have a chance at this?

Brock: You know, that’s a good question. And it depends on the loan product. There’s actually some loan products where, um, where you don’t need, you can be a startup. But to get a loan for the startup you have to have a startup and good credit. If you have a company and a startup background, that’s a tough combination. There’s not too many lenders that are lending in that scenario. If you’re a startup and you have good credit, there’s probably some options for you. Otherwise, you know, as soon as you hit six months that’s going to open up some new loan products you. If you’re six months in business and have revenue, um, so if there’s any revenue that’s verifiable through bank statements or things like that, that’s just going to open up, you know, additional loan products for you.

Eddy: Ok. Alright. Very good. So, um, there’s a lot of stuff out there right now for a business that wants to get some kind of lending. Um, there’s Kabbage, and all these other things. How is Lendio better than those, or why should I use Lendio versus something like that?

Brock: Um, ya, you know, because we have Kabbage and Ondeck, CAN and all of them at Lendio.

Eddy: Oh, really?

Brock: And instead of you guessing “which is the best fit for me,” Kabbage or OnDeck or CAN or my bank, you know, instead of taking the time and going around to each of their websites and filling out their forms, I mean, that’s a long drawn-out process, and a lot of times you don’t know what’s the best fit for you. So the way to think of us, is we are not the lender, we’re kind of like the Kayak of small business loans. Kayak has all the options there, but they make it simple to find what you need. And that’s the same thing with us. We’re going to make it easy for that business owner to figure out which loan product is best for them.

Eddy: That’s the perfect way to think about that. So I know Ann had some questions on something you’re working on that’s pretty recent actually.

Ann: Right. So, we’re really fascinated by this project you’ve started called Faces of Main Street. First of all, it’s a very, you know, bold goal. You’re trying to interview all 28 million entrepreneurs around the country, which I think is just rad. So I kinda first just wanted to ask...I wanted to know, first of all, just how you plan on gathering those stories: are people submitting? Are you going out there on the road and finding these people? How do you plan to accomplish this?

Brock: Ya, so, um, I think first of all, take a step back with Faces of Main Street. For us, we see so many business owners that, you know, we talk about Lendio all the time, we’re fueling the American Dream. We’ve got business owners that want to expand their business, want to start their business, want to hire employees, want to provide equipment, they’ve got some dream they’re trying to accomplish.

We sponsored a bike roadshow basically from the west coast to the east coast, and along the way they stopped at all these businesses. And you sit there and you hear the stories of these businesses and it’s just amazing. It’s just the coolest thing to hear how they started, and why they started, and what they’re motivation was. And because we’re passionate about that, um, we decided, hey, let’s come up, you know, let’s create this place where the stories can be told. And we saw, we saw that there’s a guy out there called, he started a site called “Humans of New York”--just kind of the same thing. He went out and started taking pictures and telling these stories of people in New York, and people got really excited about it, people started submitting their stories and their pictures, and we said “we should be doing that for business owners. We should be telling stories of business owners across the United States.” And so we came up with this concept of Faces of Main Street. We launched it on Small Business Saturday. And so we’re asking for entrepreneurs to tell their stories, we’re doing a photo contest--photographers to go out and take pictures. We’re only like ten days into it, but we already have like sixty different submissions of stories and business owners. And, so, you gotta start somewhere, and we’re excited about it. It’s a cool opportunity to tell stories of business owners.

Eddy: That’s really, really great. I love it.

Ann: That’s fantastic! So, one of the things you kind of mentioned about these entrepreneurs is how hard they work, and how inspiring that is. And, so, I kind of wanted you to, as you work with all these entrepreneurs, to maybe talk about is there such a thing as an “overnight success,” with a business. Or have you run into that, or is it just a myth?

Brock: You know, I’m sure there is, but I haven’t seen it.

Eddy: I haven’t either! I’m lookin’ for it.

Ann: Alright! Ok, we’re going to stick with hard work.

Brock: When I first started my first company, the predecessor to Lendio, um, when I first became an entrepreneur, you read about these entrepreneurs that, whatever magazine that built a company and flipped it and sold it and are drivin’ Lamborghinis and all that kind of stuff. You get caught up and excited about that, and I think that, uh, you know, personally, I feel like if you get caught up on that, you make short-term decisions that come back sometimes and haunt you. And, you know, I’ve had a change of heart and a change of tune around the way I want to build a business. I’m focused on building a great business that solves a major problem and helps people and you feel good about. And, you know, I’m sure there’s people out there who have had overnight hits and one-night wonders--they’re just in the right place at the right time--of course it happens. But for 27.9 million small businesses in the U.S. it’s probably, you know, blood, sweat and tears that we all go through, early morning and late nights.

Eddy: I think that’s a pretty good evolution. A lot of us go through that. Because I’ve hit that point too. When I first started I thought, you know, let’s grow something as fast as we can, and just take over the world. And now it’s all about answering a certain question, you know, and trying to answer that question as best you can, and that gets me to work every day. So it’s fun. Ya. So, that’s really good.

Ann: I have one last question for you, Brock. So when you have these entrepreneurs and these companies come to you and they’re looking for funding, um, what do you see, are there maybe one or two kind of common road blocks that you see. They come to you, and is there something that, you know, that you maybe have to turn people away or say, “come back to us in a few months when you get to this place?”

Brock: Well, you know a lot of times, a business owner hasn’t taken care of their personal credit score. And you think, “oh, I’m a business owner, personal credit doesn’t matter.” The problem is is that business credit does matter, but there’s not a whole lot of data around business credit to go off of. So they just defer back to the business owner’s personal credit. And I think it’s important, as a business owner, to manage that and to be proactive about what your credit is, and monitor that on a very regular basis. So that when the time is ready for financing that you’ve got that in order, you know exactly where it’s at. So that’s one of the pitfalls.

The other thing is that, you know, when you think about financing, if you put yourself in the shoes of the whoever is lending you money, and they’re looking at, “if I give you a dollar, will you pay me back?”

Eddy: A $1.25!

Brock: A $1.25 or whatever is, right? And, so, um, sometimes just like with your personal credit, as you’re young, and you’re going through high school or college or whatever, you’re trying, you don’t really have any credit established. And so you might have to pay a little higher rent, or you might have to, you have to earn the trust of lenders to be able to get your credit down and get your rates down. It’s the same thing with a business owner. A lot of times you’re going to have to start with something that, alright, “I’m going to start here, and I’m going to prove that I can pay it off. My next loan is going to be larger and my rate’s going to be lower.” And I think if people think about it that way, um, you know, they, uh, they will eventually, you know, show that they can pay off that loan and they’ll get the loan they want.

Ann: Cool. That’s super helpful. Thank you, ya.

Eddy: Absolutely.

Thank you’s and end.